The Rise of Adani Stock A Comprehensive Analysis for Investors

Introduction

Adani Group has emerged as one of the most influential business conglomerates in India, significantly impacting sectors such as infrastructure, energy, and logistics. Founded by Gautam Adani, the group has grown exponentially, attracting both admiration and skepticism. With its ambitious projects and aggressive expansion strategies, Adani’s stocks have been in the limelight for investors worldwide.

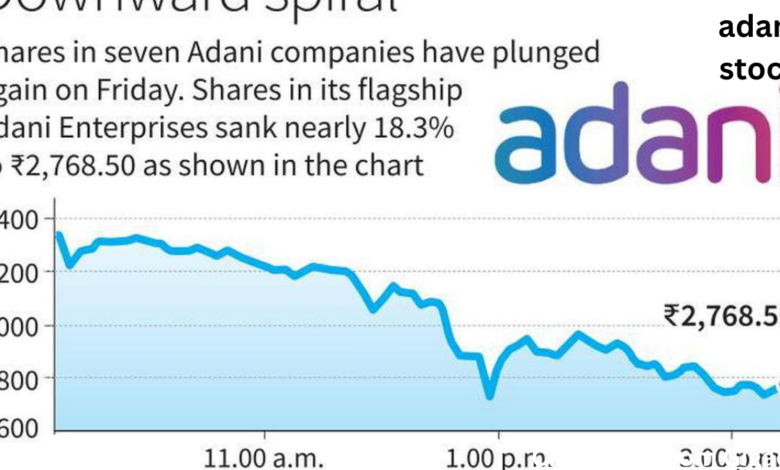

Over the past few years, Adani stocks have seen meteoric rises and occasional sharp declines, making them one of the most talked-about equities in the Indian stock market. The conglomerate’s ability to sustain growth amid global economic fluctuations has intrigued investors, making it essential to analyze its stock performance. This article aims to provide an in-depth analysis of Adani stocks, exploring their history, performance, influencing factors, risks, and future prospects for investors.

Background of Adani Group & Its Market Presence

Adani Group, founded in 1988, started as a commodity trading business before diversifying into infrastructure, power generation, mining, and ports. Over the decades, the company has established a strong presence in India and expanded internationally, making it a formidable player in global markets.

Adani’s core businesses include renewable energy, transportation, and logistics, contributing significantly to India’s economic growth. With multiple subsidiaries like Adani Ports & SEZ, Adani Green Energy, Adani Transmission, and Adani Enterprises, the conglomerate has created a diversified business model. This expansion has positioned it as a market leader in critical sectors, attracting both domestic and foreign investments.

The stock market capitalization of Adani companies has seen exponential growth, placing Gautam Adani among the richest individuals globally. Adani’s strategic acquisitions and infrastructure investments have been instrumental in shaping India’s industrial landscape, ensuring continued investor interest.

Adani Stock Performance Over the Years

Adani stocks have witnessed a rollercoaster ride, characterized by rapid gains and occasional setbacks. Over the past decade, Adani Group’s market capitalization has surged, outperforming many benchmark indices. Stocks like Adani Enterprises, Adani Green Energy, and Adani Ports have shown consistent growth, making them attractive investment options.

The bullish run of Adani stocks can be attributed to strategic expansions, favorable government policies, and robust financial performance. Adani Green Energy, for instance, benefited from the global shift towards renewable energy, leading to a sharp surge in stock value. On the other hand, Adani Ports & SEZ leveraged India’s growing maritime trade, securing a competitive advantage.

However, Adani stocks have also faced volatility due to regulatory scrutiny and short-seller reports. Market corrections, global economic trends, and geopolitical tensions have occasionally led to stock price fluctuations. Despite these challenges, Adani stocks have demonstrated resilience, reaffirming investor confidence in the group’s long-term growth trajectory.

Factors Influencing Adani Stock Prices

Several factors influence the performance of Adani stocks, ranging from macroeconomic conditions to company-specific developments. Understanding these factors can help investors make informed decisions.

- Government Policies & Regulations: Favorable policies, such as renewable energy incentives and infrastructure development projects, have positively impacted Adani’s growth. However, regulatory challenges and legal disputes can create uncertainties for investors.

- Global Market Trends: The demand for sustainable energy, logistics infrastructure, and industrial development plays a crucial role in shaping Adani stock prices. Market dynamics, such as global oil prices and geopolitical tensions, can also impact valuations.

- Company Expansions & Acquisitions: Adani’s aggressive expansion strategies, including the acquisition of strategic assets, drive stock price appreciation. Expansion into new markets and sectors diversifies revenue streams, ensuring sustained growth.

- Media & Public Perception: Investor sentiment is heavily influenced by media reports, analyst recommendations, and public perception. Allegations of corporate governance issues or financial irregularities can lead to short-term stock price fluctuations.

Risks and Challenges for Adani Stocks

While Adani stocks have delivered significant returns, they are not without risks. Investors must consider the following challenges before investing:

- Market Volatility: Adani stocks have exhibited high volatility due to economic uncertainties, market corrections, and external factors such as global trade policies.

- Debt Levels & Financial Stability: Adani Group has undertaken large-scale infrastructure projects, leading to significant debt accumulation. While strategic investments drive growth, high debt levels pose financial risks, especially during economic downturns.

- Environmental & Legal Concerns: Adani’s coal mining and infrastructure projects have faced opposition from environmental activists and regulatory bodies. Legal challenges and sustainability concerns can impact stock performance.

- Geopolitical Factors: International trade relations, supply chain disruptions, and geopolitical tensions influence Adani’s global ventures. Investors must monitor external risks affecting the conglomerate’s operations.

Future Prospects and Growth Potential

Despite challenges, Adani Group remains well-positioned for future growth. The company’s focus on renewable energy, infrastructure development, and digital transformation presents substantial opportunities.

- Renewable Energy Expansion: Adani Green Energy aims to become a global leader in clean energy, with ambitious solar and wind power projects.

- Infrastructure & Ports Growth: Adani Ports continues to expand its footprint, capitalizing on India’s growing trade and logistics demand.

- New Ventures & Technological Innovations: Investments in data centers, smart infrastructure, and electric mobility position Adani as a future-ready conglomerate.

Analysts predict that Adani stocks will continue their upward trajectory, provided the company maintains strong governance, financial discipline, and strategic execution.

How to Invest in Adani Stocks?

Investing in Adani stocks requires careful research and market analysis. Here are key steps for investors:

- Understand Market Trends: Study historical performance and analyze financial reports before investing.

- Diversify Portfolio: Avoid overexposure to a single stock by diversifying investments across sectors.

- Monitor Risk Factors: Stay updated on regulatory changes, market trends, and company developments.

- Use Investment Avenues: Invest through direct stocks, mutual funds, or exchange-traded funds (ETFs) with Adani exposure.

Conclusion

Adani stocks offer lucrative investment opportunities, backed by the group’s strong market presence and growth strategies. However, investors must be mindful of associated risks, including volatility, debt levels, and regulatory concerns. Conducting thorough research, staying informed on market trends, and diversifying portfolios can help investors maximize returns while mitigating risks.

Frequently Asked Questions (FAQs)

- What is the current valuation of Adani stocks?

- Investors can track Adani stock prices through stock exchanges like NSE and BSE.

- Is Adani stock a good investment for beginners?

- While promising, Adani stocks require due diligence due to market fluctuations.

- How does Adani compare to other conglomerates like Reliance?

- Both companies dominate their respective sectors, but Adani has a stronger focus on infrastructure and renewable energy.

- What are the biggest risks of investing in Adani stocks?

- Market volatility, debt concerns, and regulatory challenges pose risks to investors.

- Does Adani Group pay dividends?

- Some Adani companies distribute dividends, but the payout varies annually.

You May Also Read: https://vbinweekly.com/euro-2024-groups-table/